Lending Club

Lending Club Super App

0-1 DESIGN | SENIOR Product Designer

8 Week Validation

The Opportunity

Create an inter-connected strategy between banking and lending, leveraging a multi financial product marketplace as well as a differentiated digital feature set that solves core frictions and meets the emotional needs of Lending Club members. By leveraging the existing bank charter and utilizing current vendor relationships, the product can offer an industry leading member value exchange and access a more diverse revenue base.

Highlights

Streamlined new account creation captures the user in the lending application process, immediately adding value with a Credit Snapshot, aggregated debt information collected through Identity Verification and an attractive Industry-Leading Rate with the incentive to receive funds right away by opening a Rewards Checking Account

The Super App’s dynamic home page creates a contextually-prioritized newsfeed of information based on the user’s financial behaviors

An aggregated Credit Card view enables a holistic view of spending and payments while also leveraging Lending Club’s ability to offer micro loans – an alternative to paying high interest credit card rates – through a feature called “Sweep and Save”

An amalgamated loan hub allows Super App to monitor loan payment progress while enabling the business to offer reconsolidating services and new product offers when the time is right

A feature-rich rewards program that includes cash back and point redemption benefits user’s spending behaviors as well as their positive financial behaviors

The Approach

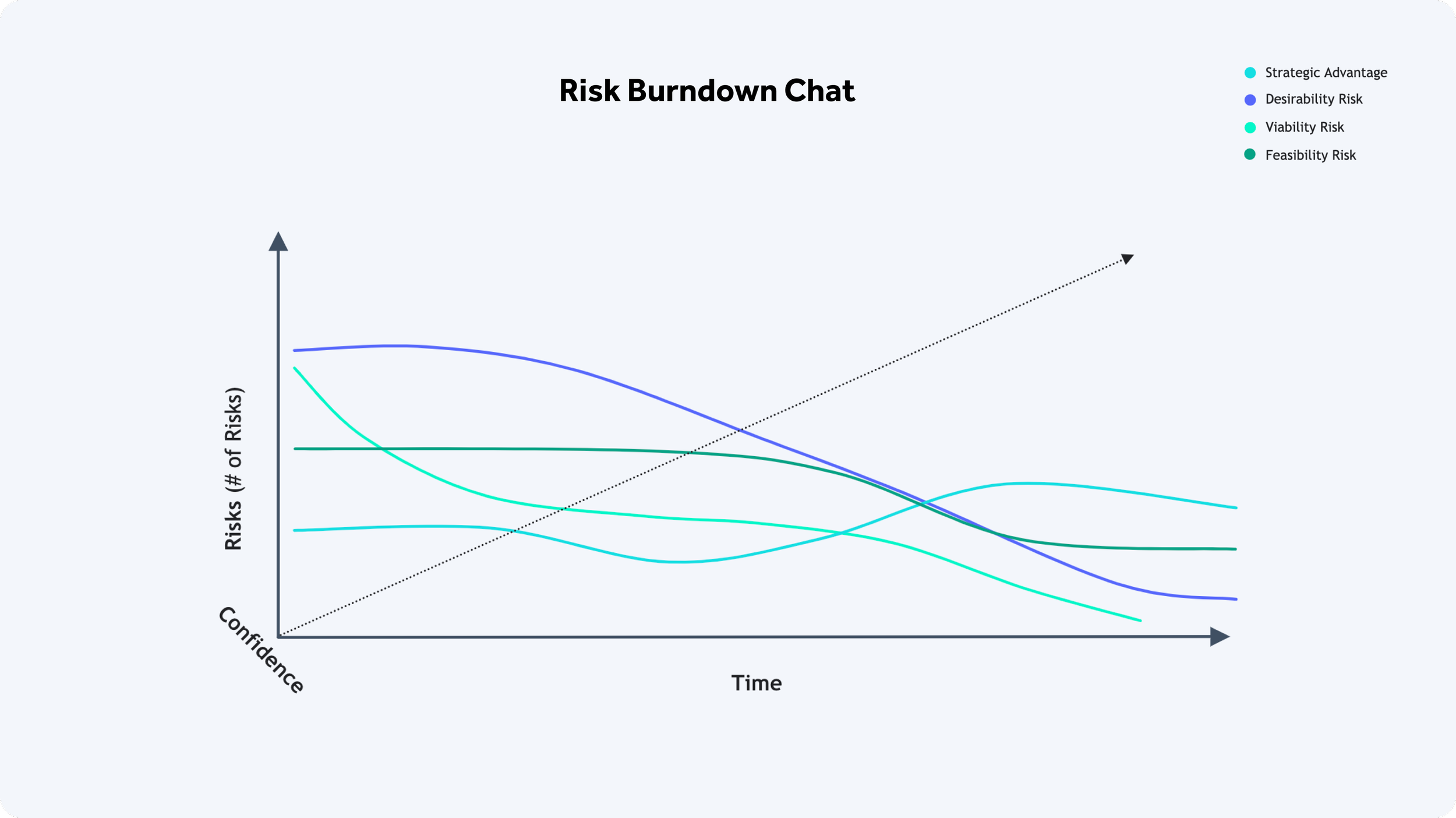

Burn down risks in order to validate the transformation of this tech-forward lending company’s core experience, proving out unique financial offerings that layer in an array of differentiated digital features, ultimately creating a seamless and integrated solution for its members.

Key Questions to Consider:

Strategic Advantage: Does Lending Club have a strategic advantage for a Super App?

Desirability: Does Super App’s value proposition fill a compelling unmet need for users?

Viability: Is the investment case compelling?

Feasibility: Is the Super App build something that can be built?

Market Trend Studies and Competitive Analysis were conducted to inspire ideation

This included companies such as banking institutions offering multi-product solutions, other personal loan providers, and various personal financial management tools.

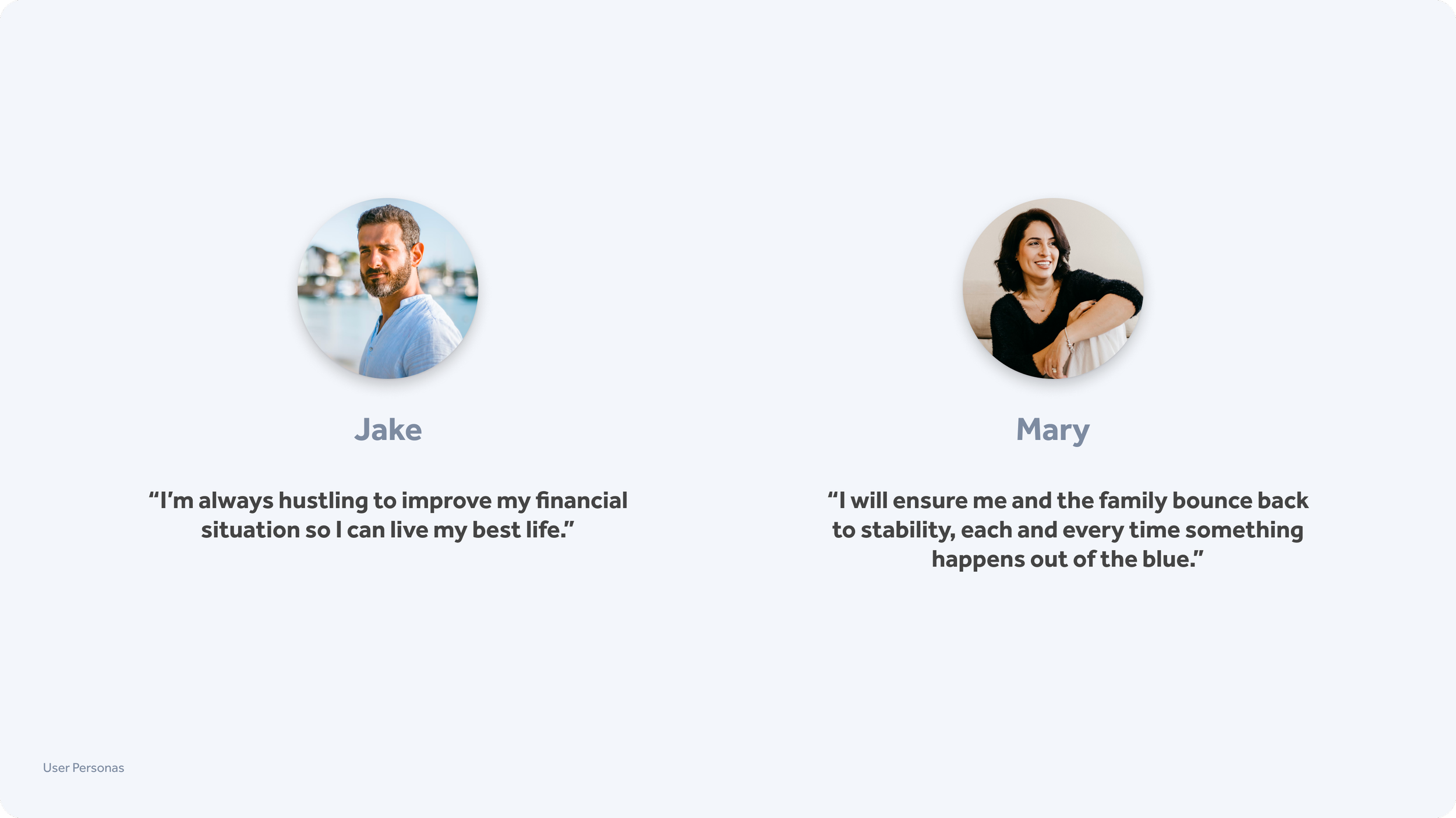

User Personas were developed to establish our user’s emotional needs and market pain points

Based off of initial ethnographic studies as well as data from the current Lending Club member base, these personas were continually refined through ongoing ethnographic research, including user interviews and quant research, throughout the validation.

Ethnographic Interviews & Research Synthesis

Discussion guides and card sorts identified jobs to be done, unmet emotional needs, and desired outcomes. Over time this initial research shaped value propositions and those propositions were added into additional qual and quant testing.

Super App Validation Video

The Solution

Super App caters to the unmet needs of members’ Spend, Borrow, and Growth behaviors, providing the user with an aggregated view of their financial picture as well as an innovative set of financial tools, such as real-time spending insights, budgeting aids, mobile payment options, personalized financial recommendations, and rewards for positive financial behavior.